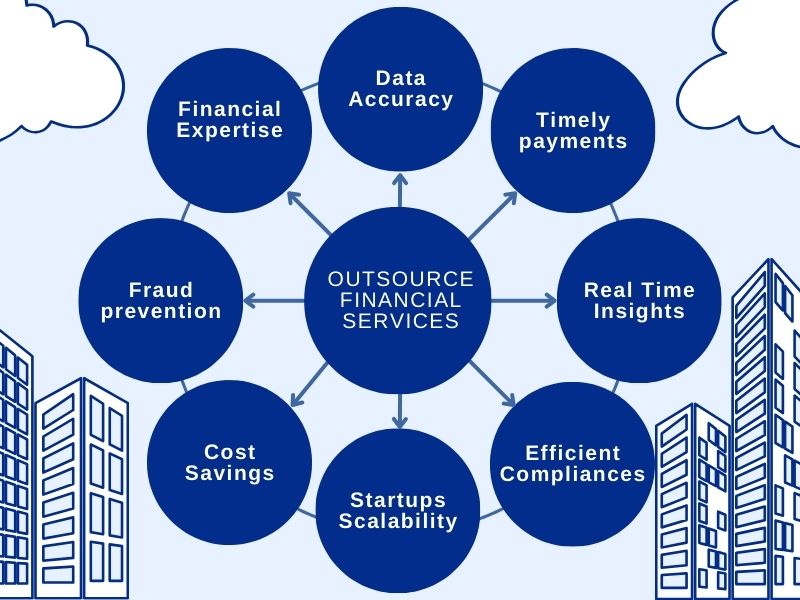

Accurate cash flow forecasting is essential for businesses to sustain financial stability and drive growth. Many organizations are turning to outsourcing accounts payable to optimize their forecasting processes. This strategic approach streamlines operations and equips businesses with real-time financial insights to make well-informed decisions.

Improving Data Accuracy with Outsourced Accounts Payable

Outsourcing accounts payable enhances the accuracy of financial data, a crucial factor for effective cash flow management. By automating tasks like invoice processing and payment scheduling:

- Errors in data entry are minimized.

- Businesses can forecast cash inflows and outflows more precisely.

- Operational efficiency increases.

Ensuring Timely Payments

A major advantage of outsourcing is timely payment processing. Professional providers manage vendor payments promptly, which:

- Prevents late payment penalties.

- Strengthens relationships with suppliers.

- Builds a reputation for reliability.

Leveraging Advanced Tools for Real-Time Insights

Outsourced services often use cutting-edge tools to track financial data in real time. These tools enable:

- Up-to-date financial reporting.

- Better planning and cash flow management.

- Immediate access to detailed financial insights.

Small Businesses Reap the Benefits

For small businesses with limited resources, outsourcing accounts payable provides professional expertise without the need for a full-time finance team. Benefits include:

- Cost-effective financial management.

- Streamlined operations to handle accounts payable efficiently.

- Greater focus on core business areas.

Compliance and Governance Made Simple

Outsourced providers ensure compliance with tax regulations and financial standards. Their expertise helps:

- Align accounts payable with current laws.

- Reduce risks of penalties.

- Enhance overall financial governance.

Reliable Cash Flow Forecasting

Error-free accounts payable processes make cash flow forecasting more dependable. Businesses can:

- Detect trends in spending and revenue.

- Adjust financial strategies proactively.

- Plan for long-term growth with greater confidence.

Significant Cost Savings

Outsourcing accounts payable reduces administrative costs, allowing businesses to:

- Save on overhead expenses.

- Reallocate resources to growth initiatives.

- Invest in other critical areas of operations.

Strengthening Vendor Relationships

Vendor relationships are vital to operational success. Outsourced accounts payable ensures:

- Vendors are paid accurately and on time.

- Trust is built with suppliers.

- Long-term partnerships are fostered.

Fraud Prevention and Security

With strict security protocols, outsourcing providers protect businesses from fraudulent activities. Key measures include:

- Implementation of advanced security systems.

- Safeguarding sensitive financial data.

- Ensuring transaction integrity.

Scalable Solutions for Startups

Startups often face fluctuating financial needs. Outsourcing provides:

- Scalable solutions to accommodate business growth.

- Flexible support tailored to changing requirements.

- Access to financial expertise without hiring in-house teams.

Access to Advanced Technology

Outsourced providers utilize sophisticated software to automate processes. Features include:

- Automation of accounts payable workflows.

- Detailed reporting for precise forecasting.

- Streamlined payment operations.

Managing Global Operations

For global businesses, managing payments across regions is challenging. Outsourcing ensures:

- Standardized processes across locations.

- Compliance with international regulations.

- Enhanced financial transparency.

Expertise in Financial Analysis

Outsourced professionals bring specialized expertise to improve financial forecasts. They help businesses:

- Analyse payment trends.

- Identify inefficiencies in processes.

- Implement actionable insights for optimization.

Increased Transparency and Visibility

Real-time dashboards provided by outsourcing services allow businesses to:

- Monitor payments and invoices effortlessly.

- Gain clear insights into financial activities.

- Make better financial planning decisions.

Reducing Administrative Workload

Outsourcing relieves internal teams of administrative burdens. This enables:

- Staff to focus on strategic financial tasks.

- Enhanced efficiency in budgeting and forecasting.

- Improved overall business performance.

Adapting to Changing Market Conditions

Outsourced services offer flexibility to match market fluctuations. Key benefits include:

- Scalability to handle varying payment volumes.

- Seamless operations during dynamic changes.

- Reliable cash flow management under shifting conditions.

Driving Growth with Improved Forecasting

Accurate cash flow forecasting, facilitated by outsourcing, supports growth by enabling better decision-making. Businesses can:

- Plan investments with confidence.

- Pursue expansion opportunities strategically.

- Maintain financial stability during growth phases.

Outsourcing accounts payable is an effective strategy for enhancing cash flow forecasting. It ensures data accuracy, compliance, and cost savings while improving vendor relationships. By leveraging expert services and advanced technology, businesses gain the insights needed to achieve long-term financial success.